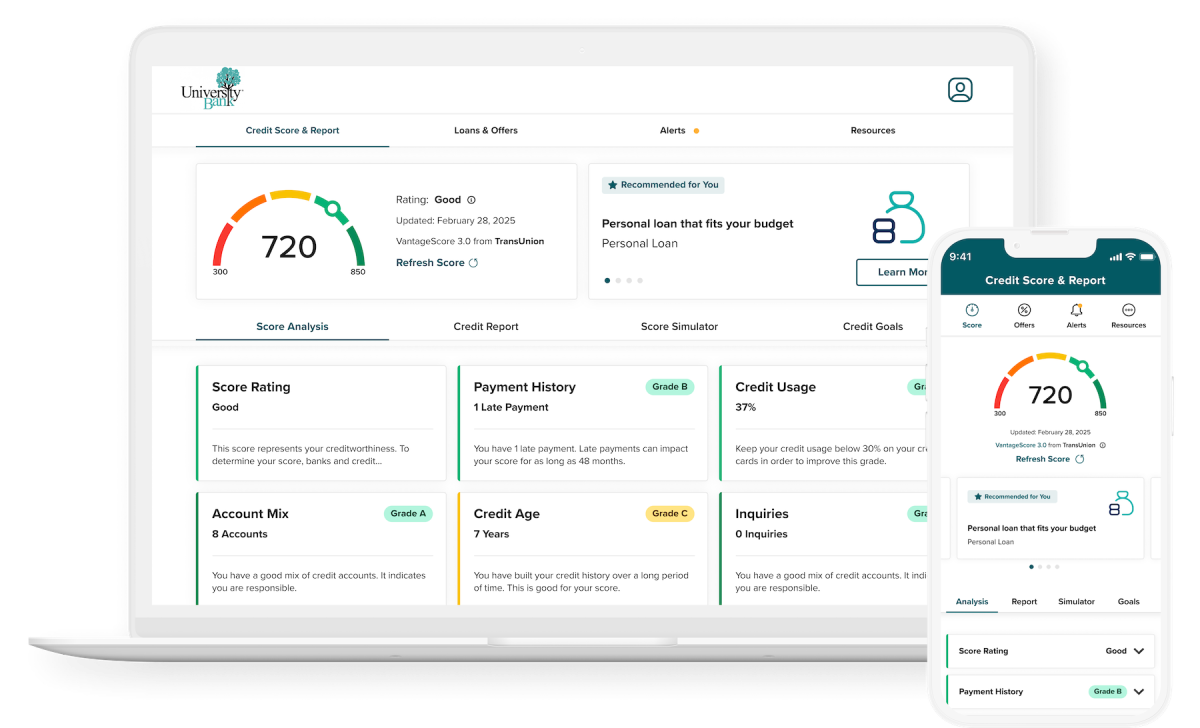

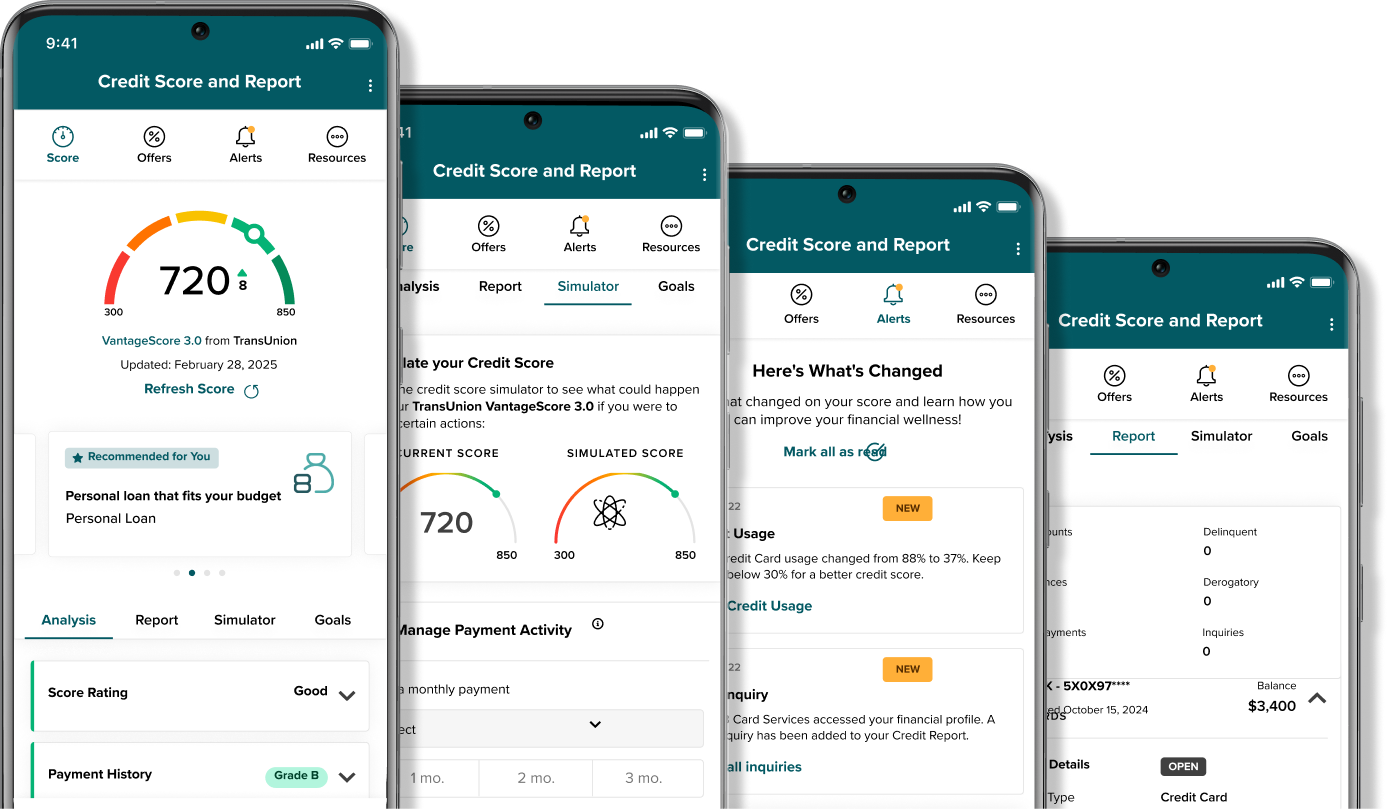

Staying on top of your credit

has never been easier

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

All of this without impacting your credit score.

You can do this ANYTIME and ANYWHERE and for FREE.

Benefits of Credit Sense

The benefits are endless, so there is no need to wait.

Daily & Secure

With Credit Sense, you can easily check your credit score and report on our mobile app and online banking. Stay informed and in control of your credit health wherever you are.

Keep an eye out for the launch of this game-changing tool that puts the power of credit management right at your fingertips.